Eaves at Trumbull- $68,900,000 debt/equity for multifamily purchase. High leverage, non-recourse, floating rate loan with cap, liberal prepayment rights and a flexible exit strategy.

The Lofts at Harmony Mills- $19,500,000 construction and interim financing of 1850 lofts into multifamily apartments, financed NYS historic tax credits.

The Geneses Grande Hotel- $10,600,000 syndicate of 3 banks to provide fixed rate on-book financing, overcame concerns with non branded hotel in tertiary market.

PA-NJ Multifamily Portfolio- $123,500,000 fixed rate loan for 5 properties. Risk free rate lock at application, 7 year term, portfolio lender, liberal prepayment rights, only soft cross collateralization.

B+ Multifamily Purchase, Stamford, CT- $26,300,000 loan for the opportunistic purchase of a high-end apartment complex in Stamford, CT. Achieved high leverage/great pricing despite using very near term results and projections due to an uneven operational history

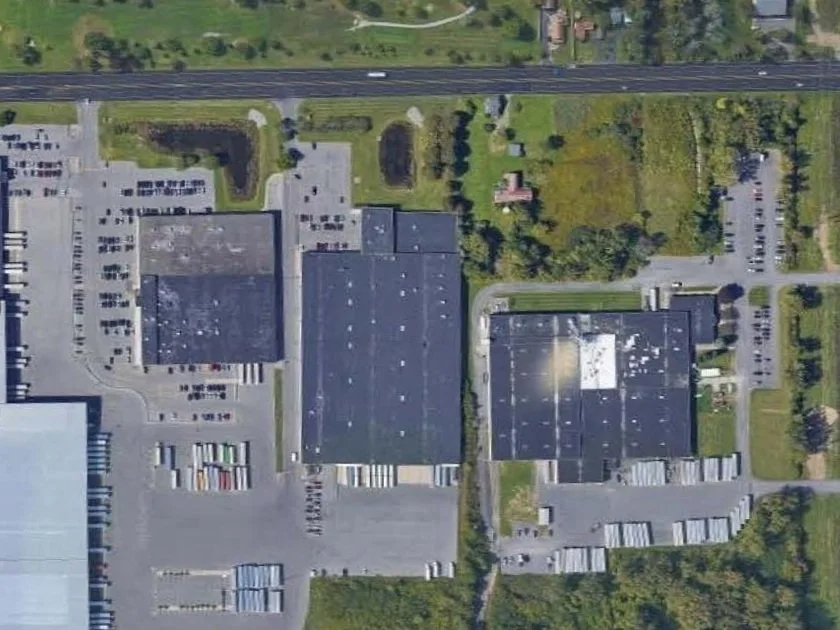

The Mall at Greece Ridge- $75,000,000 obtained high leverage debt overcoming many lease roll challenges.

Copper Beech Student Housing- $20,500,000 permanent financing from portfolio lender, overcame short operational history, flexible prepayment rights.

Merrit Station Apartments- $22,250,000 Loan for purchase, significant cap ex work and for construction of new apartment structure. Generous period of interest only, portfolio lender, unique liberal prepay structure.

Albany International Building- $29,500,000 construction and interim financing for adaptive to multifamily; also financed historic tax credits.

Soundview Apartments at Savin Rock- $14,500,000 permanent financing from niche portfolio lender, risk free rate lock at application, earn out rights .

Multifamily, New Haven, CT- $10,120,000 loan for the refinancing of a multifamily community in New Haven, CT. High Number of voucher tenants, used this tenancy base to great significant competition between regional banks and agency lenders, resulting in large cash out, fantastic pricing.

Multifamily, Hartford, CT area- $12,425,000 loan for the refinancing of a multifamily community just outside of Hartford, CT. Large Cash Out, High leverage, generous interest only period, with a flexible exit strategy and significantly more loan dollars than our customer expected