Creative Capital for Commercial Real Estate

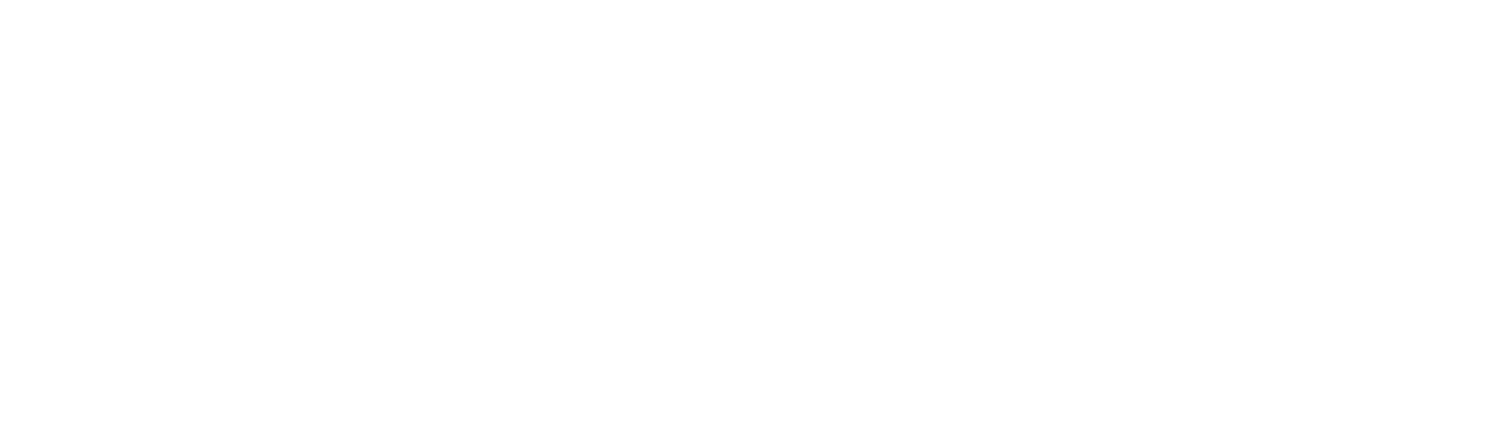

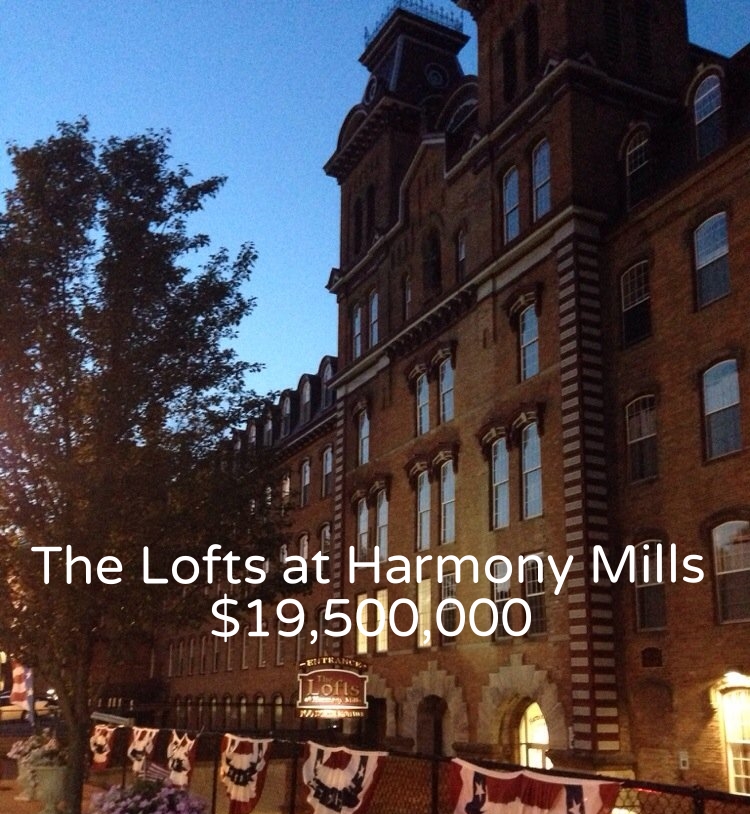

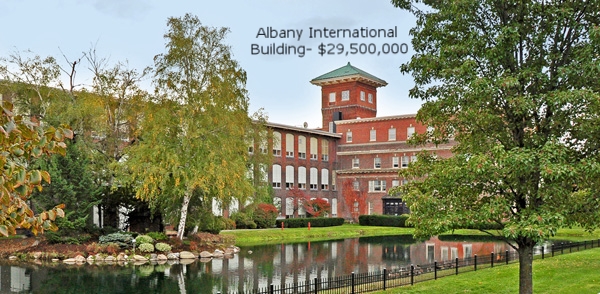

Featured Deals

About Our Firm

We arrange loans, equity, and mezzanine investments for all types of commercial real estate including multifamily, hospitality, student housing, offices, industrial, retail, self-storage, condominium conversion, redevelopment, and all types of healthcare facilities.

We also arrange structured and construction loans, including loans with layers of mezzanine or preferred equity financing. In some instances, we have arranged between 96% and 100% of the debt and equity required for purchases. Our projects range from newly constructed hotels to transitional or “out of the box” assets. We also obtain debt and equity for hard to place fundings, such as turnaround or repositioned properties. Our typical loan size averages $15 million, although we are able to obtain funding for any loan in excess of $1,500,000 and have arranged loans in excess of $100,000,000.

Our expertise is in evaluating the problems with a loan request and creating solutions to what may seem to be insurmountable issues, and to stretching the ability of investors and lenders to reach maximum investments or loan proceeds.

Capital & Venture Resources has offices in Connecticut, New York, New Jersey and Massachusetts.

Newsletter & Sign Up

August 2021 Newsletter:

$110,000,000 Loan Closing, Read How We Overcame Challenges-

One of our customers came to us to seek our help in refinancing a loan on a commercial property in a suburb of New York City. Their real estate portfolio has an aggregate value in excess of 2 Billion Dollars so they are very sophisticated. We agreed with them that the best source for this loan would likely be found in the CMBS market. They had already gone directly to the largest players in the CMBS market, so our options were limited. The loan had some real challenges including a large amount of dark space.…

For full article click here