Creative Capital for Commercial Real Estate

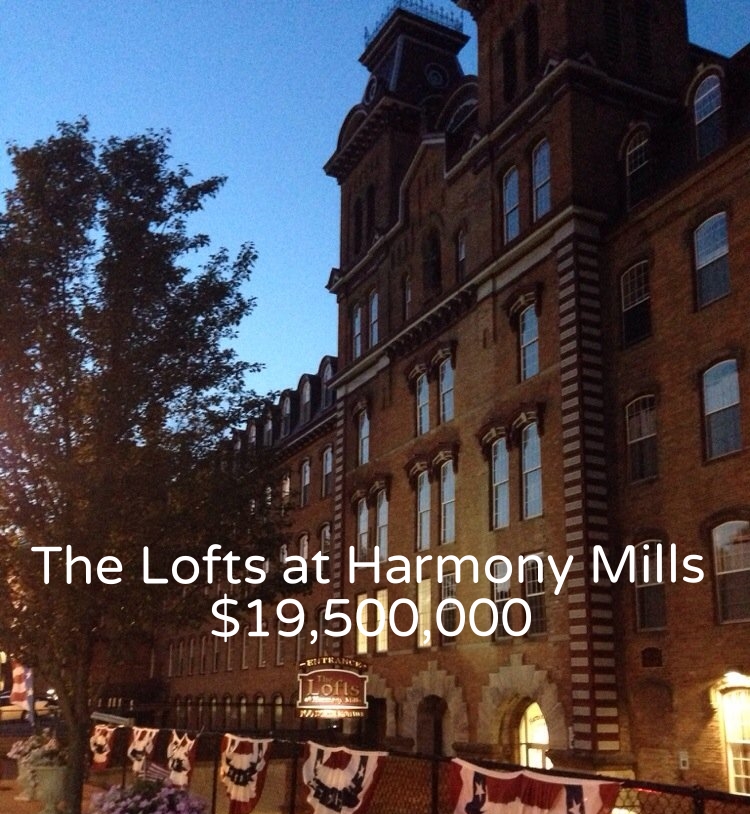

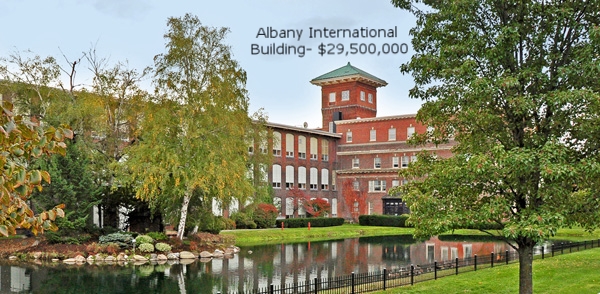

Featured Deals

About Our Firm

We arrange loans, equity, and mezzanine investments for all types of commercial real estate including multifamily, hospitality, student housing, offices, industrial, retail, self-storage, condominium conversion, redevelopment, and all types of healthcare facilities.

We also arrange structured and construction loans, including loans with layers of mezzanine or preferred equity financing. In some instances, we have arranged between 96% and 100% of the debt and equity required for purchases. Our projects range from newly constructed hotels to transitional or “out of the box” assets. We also obtain debt and equity for hard to place fundings, such as turnaround or repositioned properties. Our typical loan size averages $15 million, although we are able to obtain funding for any loan in excess of $1,500,000 and have arranged loans in excess of $100,000,000.

Our expertise is in evaluating the problems with a loan request and creating solutions to what may seem to be insurmountable issues, and to stretching the ability of investors and lenders to reach maximum investments or loan proceeds.

Capital & Venture Resources has offices in Connecticut, New York, New Jersey and Massachusetts.

Newsletter & Sign Up

December 2020 Newsletter:

Hi Friends,

Do you believe that banks are not making construction loans for the most part, particularly in NYC Metropolitan/Tri State Area? One of our very experienced customers believed that was the case and we surprised them in arranging a $15,000,000 construction and interim loan for a Self-Storage project in New Rochelle, NY, which closed the day before Thanksgiving…

For full article click here